Check policies with unsurpassed quality, accuracy and efficiency.

Patra's Policy Checking AI is the industry-leading solution designed to automate the tedious process of policy checking while reducing E&O exposure and ensuring the accuracy and quality of bound policies.

.png)

Discover your Policy Checking AI potential today!

Our patented process prioritizes accuracy and completeness while reducing rework and review time for agencies. Leveraging Patra’s 900+ point checklist, discrepancies are quickly identified and shared via a color-coded, error report summary for account managers to easily scan and assess.

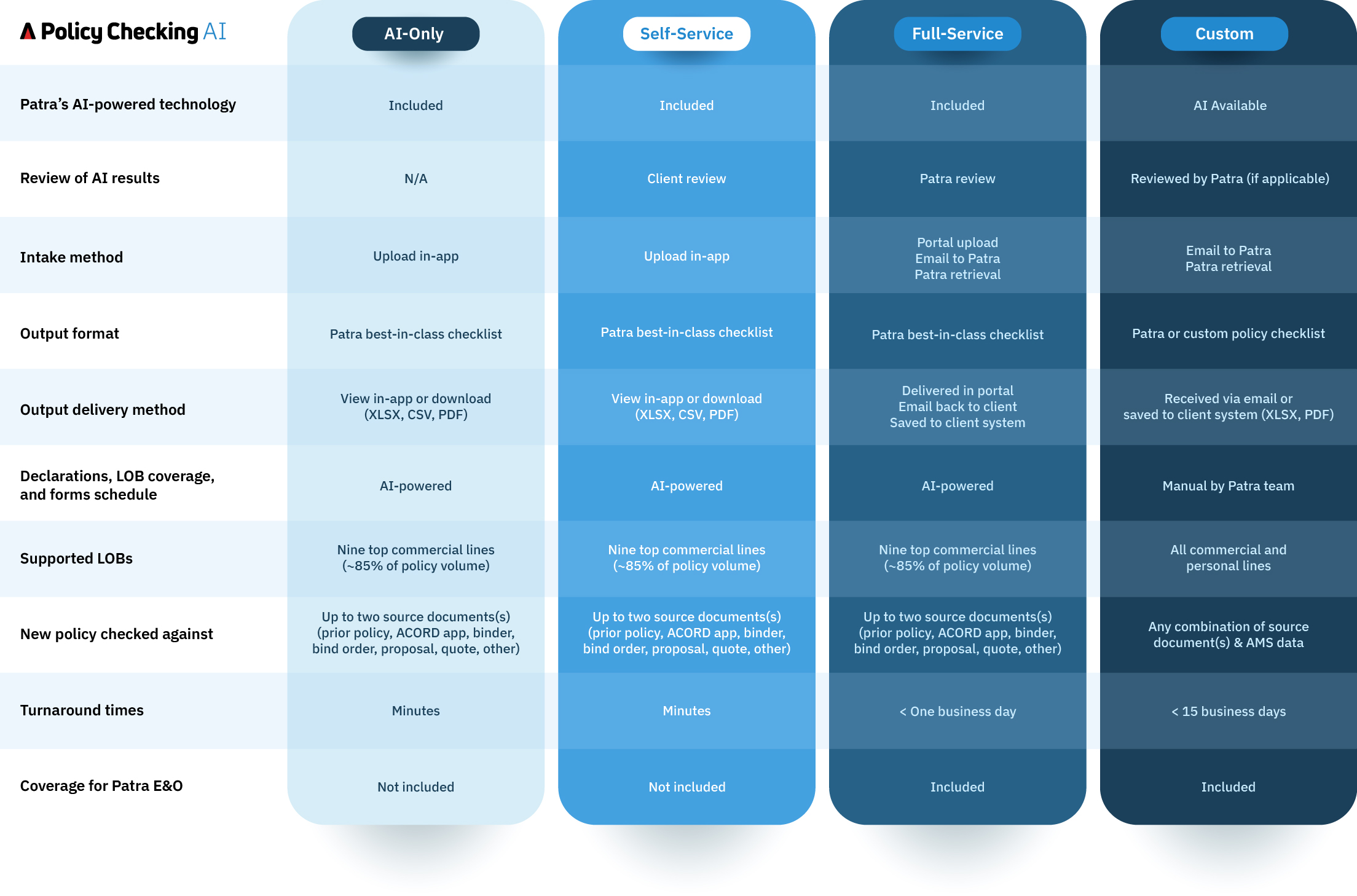

AI-Only

Streamlined solution using refined AI algorithms to extract, analyze, and compare policy data without human review. Ideal for organizations seeking accelerated processing while maintaining internal oversight.

Self-service

Equips in-house teams with industry-leading AI automation through an intuitive interface. Extracts, compares, and highlights discrepancies between policy versions with unparalleled speed and accuracy.

Full-service

Combines AI technology with dedicated Patra processing executives who manage the entire process. Includes final human oversight and E&O risk transfer for every policy checked.

Custom

White-glove service with tailored workflows, customized quality control, and specialized reporting aligned with your unique requirements. Includes complete E&O risk transfer and full process management.

Ready to learn more about Patra's Policy Checking solutions? Contact us today to review your current policy checking process, walk through a complete demonstration of Policy Checking AI (full- and self-service), and determine which solution best fits your operational goals.

Patra AI platform boosts insurance workstream flexibility

Flexible new solution options to help insurance organizations adapt their operations amid a rapidly evolving market.

Read the article5 AI opportunities for retail insurance agencies in 2025

Here are the best digital transformation opportunities for retail insurance agencies in 2025.

Read the articleThe power of automation in insurance

Delve into the benefits of automation in insurance and explore why it matters.

Read the article2025 tornado season: Are retail insurance agencies prepared?

Discover how AI-powered policy checking innovation can help.

Read the articleE&S insurance trends: High risk, higher expectations

As E&S becomes more mainstream, wholesalers must elevate their service quality to meet heightened service expectations.

Read the articleStep-by-step automated processing

.png)

Lines of business available:

- BOP

- Commercial Automobile

- Commercial General Liability

- Commercial Package

- Commercial Property

- Commercial Umbrella

- Cyber Liability

- Directors and Officers Liability

- Employment Practices Liability Insurance

- Excess Liability

- Professional Liability

- Workers Compensation

Workstream flexibility options

Policy Checking AI is the leading solution to check policies with higher accuracy, greater efficiency, and faster processing.

ACCURACY OF CHECKED POLICIES

AGENCY LOAD & BACKLOG ELIMINATION

FASTER THAN MANUAL PROCESSES

Real clients - Real results!

Checking policies in under 10 minutes

"This solution has been so easy to use, I was quickly able to setup a few clients and complete a policy check in under 10 minutes."

Massive efficiency gains

"Form comparison is going to be a huge win for our agency and create massive efficacy gains for our teams."

Reduced efforts by half

"We’re able to immediately cut our policy checking effort in half for simple policies, on larger policies this will reduce our manual effort by 80-90%."

"Form description and comparison review are total game changers."

"Our team can be skeptical of new technology, abut after seeing other team members leveraging the solution, they couldn't wait to get their hands on it."

"We’re easily able to check policies in just a few minutes, compared to manual policy checking, this is so efficient."

"We finally have technology available for our policy checking teams!"

Ready to learn more about Patra's Policy Checking solutions? Contact us today to review your current policy checking process, walk through a complete demonstration of Policy Checking AI (full- and self-service), and determine which solution best fits your operational goals.